How to Avoid Cashier's Check Fraud

I break down the red flags to look out for using real fraud attempts I've received.

Cashier’s Check fraud has been around for years and isn’t going away anytime soon. If you work as an independent tutor on a regular basis for at least a year, I’d be shocked if you didn’t encounter it at least once.

While the exact details of each scam vary, there are common patterns to look out for:

They request to email or text instead of using the platform’s messenger

Obviously not every such request is a scammer. Many people are just looking to pay you outside the marketplace they found you on to avoid fees. But every scammer will ask you to go off platform. So if you see the student who reached out to you has added payment information, you can be pretty certain that it’s not a scammer.

Poor grammar, broken English

This is universal. I’ve seen this scam 5-10 times by now and I’ve yet to come across an email or text message with perfect English grammar. This is another factor that is necessary but not sufficient to prove that you’re dealing with fraud. There are plenty of legitimate students whose written requests contain broken English.

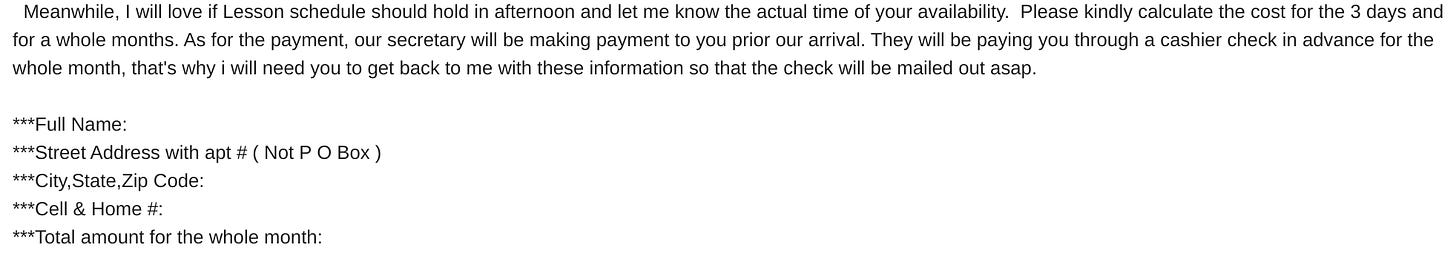

They ask to send payment for a month’s worth of lessons in advance:

This is where things should start to feel sketchy. Real students don’t do this. Think about it: why would they want to buy a month’s worth of lessons when they can sign up for 1 no-risk lesson with you to ensure it’s a good fit first. Note that not every scammer will mention that they’re sending a cashier’s check. But if they do, run.

So what happens if you give a scammer your address and they send the check?

To be clear: never do this. In the examples below, I had already realized that this was a scam so I gave the scammer the address of the U.S. Postal Inspection Service.

But here’s what would happen: you’d receive a cashier’s check for an amount that is more than the price you quoted them. Notice in the first email below my rate for a month of lessons is set at $2,400. Then when he emails me to let me know he sent the check, suddenly the amount is $4,750.06.

In real life I told the scammer that I’d reported him shortly after I received the second email and never heard from him again.

But if I hadn’t caught on yet, he would’ve next asked me to go cash the $4,750.06 cashier’s check / money order at my bank and then wire transfer the “accidental” extra $2,350.06 back to him. My bank would assume the cashier’s check is valid, so it would credit my account the $4,750.06 and allow me to wire him the funds.

The problem is, the cashier’s check is a fake.

Within a few business days it would’ve bounced and my bank would then deduct the entire $4,750.06 from my account. If I didn’t have enough to cover that, I could be charged additional overdraft fees. Meanwhile, the $2,350.06 would already be safe and sound in the thief’s hands.