How Big Are Tutoring Marketplaces?

What the new Andreessen Horowitz 'Marketplace 100' tells us about the state of the tutoring industry today

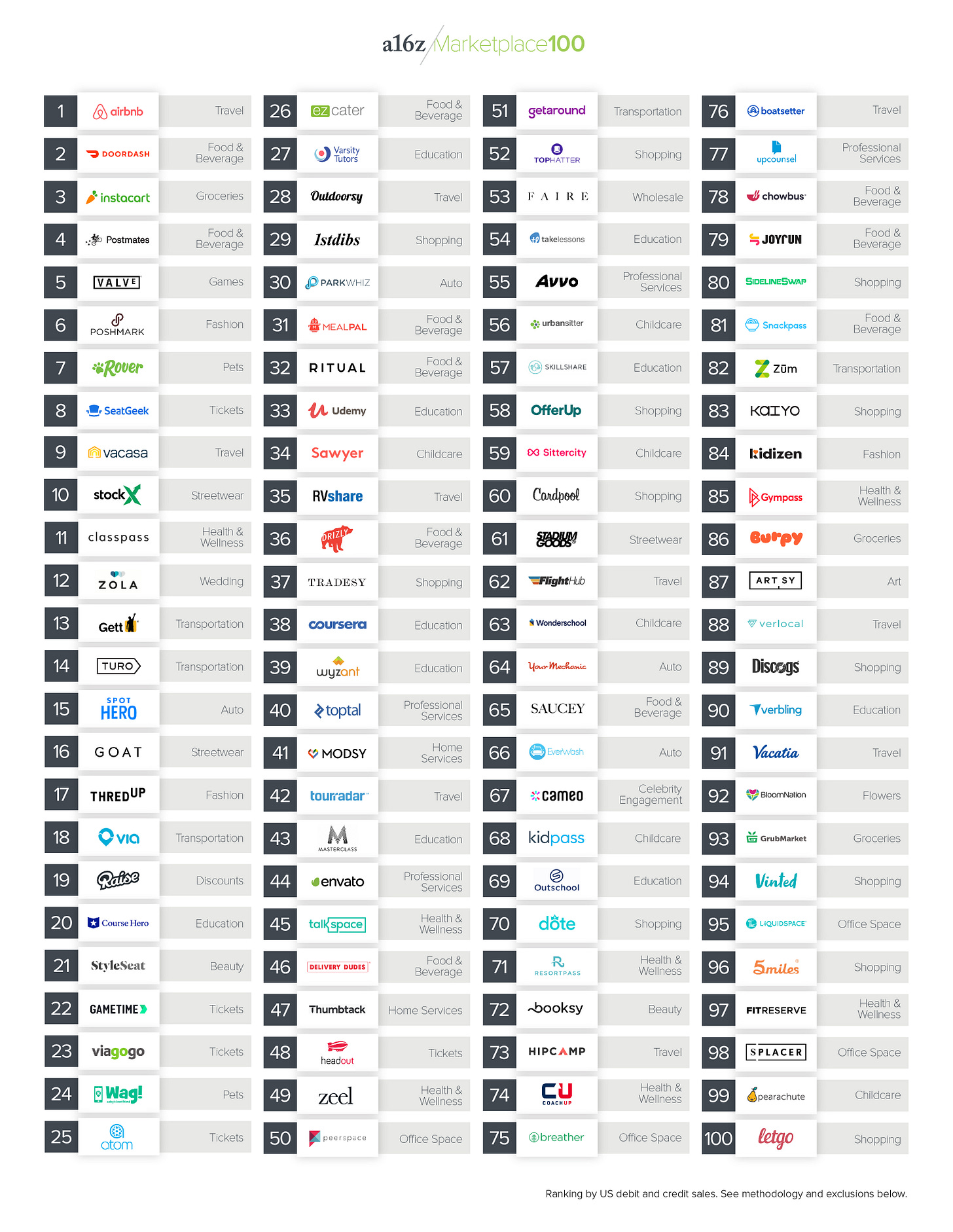

Last week, VC firm Andreessen Horowitz revealed their first Marketplace 100 report, which they called “a ranking of the largest and fastest-growing consumer-facing marketplace startups and private companies.” See the full list below:

4 tutoring marketplaces made the list

Varsity Tutors, Wyzant, TakeLessons, and Verbling are all marketplaces dedicated to tutoring. Others on the list, such as Thumbtack, are more generalized marketplaces but offer tutoring as a category.

Using publicly available information, we can estimate the size of some of these companies today

Varsity Tutors: Based on an interview with the CEO, startup 1stdibs sold $250 million in Gross Merchandise Value (GMV) in 2018. Assuming that their GMV went up in 2019, that means Varsity Tutors had a GMV of over $250 million last year, since they’re above 1stdibs on the list (27 vs. 29).

Note that GMV is the total value of the goods/services sold by a company, not the revenue collected by that company. To calculate revenue, we multiply the GMV by the “take rate,” the % the company collects from each transaction.

While it’s hard to pin down a take rate for Varsity Tutors since they have different pricing packages for students and they pay tutors different amounts depending on the subject, from my research it seems like the average tutor hourly pay is around $20/hour, while the average student is billed $65/hour for tutoring. That means Varsity Tutors has a very high take rate of nearly 70%.

Based on those numbers, we can estimate that Varsity Tutors made at least $175 million in revenue in 2019.

Wyzant: Since Wyzant is listed 39th, we can assume $250 million serves as a ceiling for Wyzant’s 2019 GMV. To find the floor, I looked to an analysis of Envato’s public API, which determined that Envato sold at least $200 million in GMV in 2017. So we can assume that Wyzant’s GMV is somewhere between $200 - $250 million.

Wyzant’s take rate is easier to calculate: they take 25% from the tutor and 9% from the student, for a total of 34% on each transaction. So I’d estimate Wyzant’s revenue was somewhere between $68 - $85 million in 2019.

Despite the large size of these companies, they have plenty of room to grow

According to a report by Zion Market Research, the global private tutoring market was valued at $96 billion in 2017, and is expected to nearly double to $177 billion in 2026. Today, we can assume that the biggest tutoring marketplaces in the U.S. only account for around $500 million, a huge number but still less than 1% of that number!

Even if U.S. marketplaces capture the same % of the global market that they are today, Zion’s research suggests that Wyzant and Varsity will be double the size they were in 2017 by 2026.

But it’s not hard to imagine Wyzant and Varsity Tutors gaining more market share over time. As their revenues continue to grow, they’ll be more able to outbid independent tutors and smaller companies for Google and social media advertising. As I discussed in a recent post, keywords that include the word “tutor” are expensive. As these marketplaces aggregate more and more students and tutors, they’ll continue to aggressively bid against each other, pouring revenues into advertising and essentially making it impossible for small companies to advertise on “tutor” keywords.

The answer? Don’t fight the trend, join it. Even if you tutor students through your own website today, you should also be on at least one of the major marketplaces!

10 education companies in the top 100 marketplaces shows consumers’ preferences have shifted

In addition to the 4 tutoring companies, 6 companies offering online courses made the cut (Course Hero, Udemy, Coursera, Masterclass, Skillshare, and Outschool). The overall takeaway is clear: people are going online to learn, whether that means from a course or from a private tutor.